For many people, claiming vehicle damage can be a difficult procedure. Customers often battle loads of forms, checks, and conversations from beginning to end. Among the common causes of headaches are slow claim handling confusing information and difficult repair costs and coverage policies. These problems usually make people unhappy and suspicious, which indicates that the old approach of handling claims has to be changed greatly. People in our fast-paced modern environment want better and more efficient experiences in all spheres, including insurance.

As more and more consumers demand fast, accurate services with the aid of Automating Vehicle Claim Management using artificial intelligence, digital tech growth has changed what consumers expect. In the insurance industry, this shift has spawned demand for simpler, more intelligent solutions.

In this blog, we delve into how AI is Automating Vehicle Claim process by automating defect detection and providing instant, accurate repair estimates and how this innovation addresses common challenges faced by consumers

How the Insurance Market Looks Now

The emergence of new customer preferences, alongside technology trends, has significantly impacted the insurance business. Digital transformation is at the forefront, with a number of insurers investing in innovations aimed to improve customer interaction and streamline their correspondence processes. Although strides are being made, the industry is still faced with the following concerns:

Steps In The Claims Process Are Complicated

A typical insurance claim processing is slow and cumbersome. Multiple steps including manual labor, accompany a great deal of paperwork which only adds to the complexity. These intricacies implies slower payments and an increased probability of errors and discrepancies.

Displeased Clients

Policyholders become displeased when claims lack timeliness and transparency, and lose trust in the system. Most clients have no way of accessing the current stage of their claim assessment which prompts doubt in the insurer.

Cost Management

Cost control will always be an agenda within an insurance company, as well as maintaining service standards when handling claim payments. Striking the right equilibrium between these twin objectives will always invite new approaches and solutions.

Accuracy and Fraud Management

There is a constant and ongoing threat to the reliability of the insurance company’s claim assessments and the possibility of fraud. Deceitful claims have the potential to wreak havoc financially, which is why insurers need efficient ways to combat these fraudulent schemes.

AI has become a global phenomenon, a trend demonstrated in a recent report published by Precedence Research showcasing the revenue growth of AI in 2021, 2022, and projecting it for the upcoming years.

Are you intrigued by the possibilities of AI? Let’s chat! We’d love to answer your questions and show you how AI can transform your industry. Contact Us

AI Steps Up Spotting Car Defects and Estimating Fix Costs

We’re excited to present our cutting-edge artificial intelligence product, which is revolutionizing the Automating Vehicle Claim process, to help to address these pressing issues. This innovative response uses cutting-edge artificial intelligence and machine learning techniques to identify vehicle flaws and provide exact repair estimates including cost of necessary parts.

The primary features of our artificial intelligence product are automatic flaw detection.

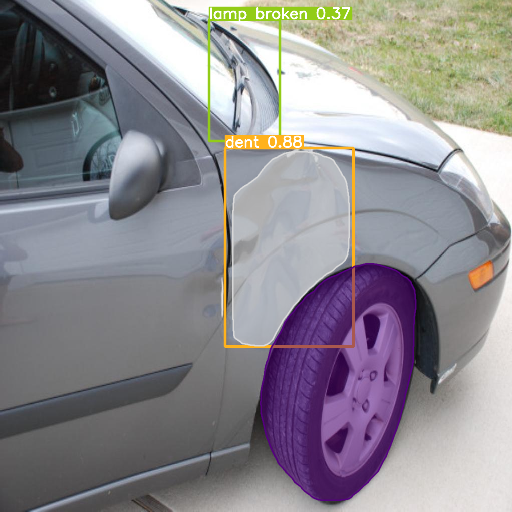

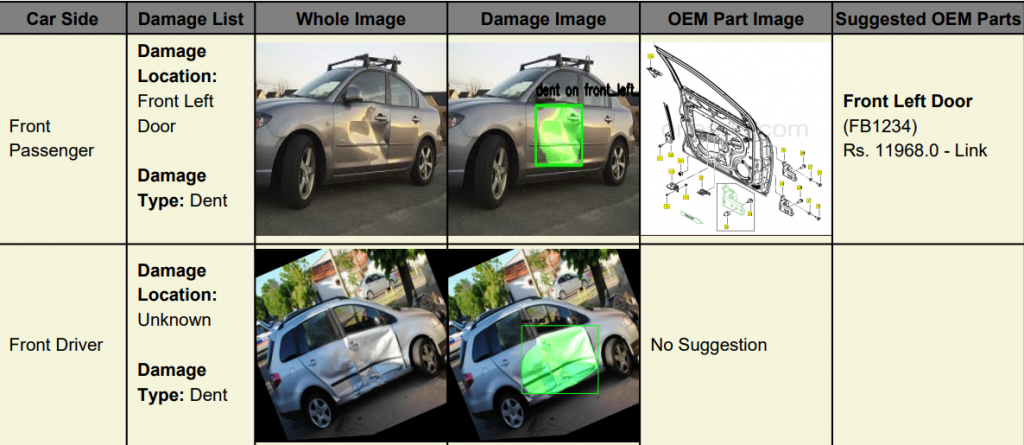

Using computer vision technology, our artificial intelligence system detects vehicle flaws. Examining images or videos of the damaged car allows the AI to remarkably precisely identify structural damage, dents, and scratches. By eliminating the need for hand checks, this Automating Vehicle Claim system accelerates the claims processing.

Automatic Flaw Detection

Our AI system applies computer vision tech to find flaws in vehicles. By examining pictures or videos of the damaged vehicle, the AI can spot issues like dents, scratches, and structural harm with incredible precision. This Automating Vehicle Claim process does away with the need for manual checks speeding up the claims process.

Quick Repair Estimates

After spotting defects, the AI creates a full repair estimate showing the price of new parts and work. You get this info right away, so there’s no need for long checks or manual reviews. Clients receive quick feedback, which lets them make faster choices and cuts down the overall time to process Automating Vehicle Claim

Clear Pricing

Our fix has a big list of parts and what they cost, so repair estimates are spot-on and easy to understand. Clients can see how the costs break down, which builds trust and makes the claims process more open. This clarity helps make the bond between insurers and those they cover stronger, as clients feel they know more and are part of the process.

Easy to Fit In

Our AI product fits right in with insurance companies’ current systems making the switch easy and keeping business running. This joining up also allows for instant updates and smoother work processes. Insurance firms can stick with their usual platforms while getting the boost from our AI tool’s new features.

Better Customer Service

By giving quick, spot-on, and clear claims reviews, our AI tool steps up the customer service game. People with policies get their claims handled faster clear updates, and less worry during the whole claims process. When customers are happier, they’re more likely to stay and spread good words, which helps the insurance company’s name and profits in the long run.

Are you intrigued by the possibilities of AI? Let’s chat! We’d love to answer your questions and show you how AI can transform your industry. Contact Us

Automating Vehicle Claim

Our AI-powered product for spotting car damage and estimating repair costs is changing how insurance companies work. It tackles the main problems with old-fashioned claims processes. By using AI, insurance firms can work more, spend less money, and keep customers happier.

Smoother Operations

AI-driven Automating Vehicle Claim cuts down on the hands-on work needed in the claims process. This lets insurance companies handle more claims faster. This quick work not only speeds up payouts but also lowers running costs. Insurance firms can use their people more focusing on tricky cases that need human thinking while AI takes care of the everyday checks.

Lowering Costs

Our AI solution has an influence on insurers’ cost management by giving accurate repair estimates and cutting down on fraud chances. Clear pricing and quick assessments do away with the need for several inspections and talks, which cuts costs even more. Insurers can keep a better handle on expenses without cutting corners on service quality.

Better Customer Trust

Clear and fair processes are key to building customer trust. Our AI solution makes sure policy owners get clear and fair evaluations, which leads to happier and more loyal customers. Customers like the quick and open process, which is very different from the old often unclear ways of dealing with claims.

Edge Over Competitors

In today’s fast-changing market, insurance companies that use cutting-edge tech like AI gain a big edge over their rivals. Our product helps insurers meet what today’s customers want, stay on top of industry shifts, and appeal to tech-savvy folks. When insurers embrace new ideas, they can stand out and win a bigger slice of the market.

Conclusion

The car claims process is ready for a shakeup, and our AI tool offers a strong answer to the problems insurers and policyholders face. By using machines to spot damage and give quick clear repair quotes, we’re making claims smoother and more effective. as AI is Automating Vehicle Claim.

As the insurance world keeps changing, using cutting-edge tech like AI will be key to meeting what today’s customers want and creating a better more productive future for everyone involved. Our AI-powered answer doesn’t just fix current problems – it also paves the way for ongoing improvements and new ideas in how claims are handled. With our product, Automating Vehicle Claim in the future will be quick, clear, and focused on the customer. This promises to have a big impact on changing the insurance industry as a whole.

Also Read:

Intelligent automation is reshaping modern systems, from PaddleOCR for Intelligent Document Processing – Automating Text Extraction with AI and Vision Transformers: Unlocking New Potential in OCR – A Game-Changer in Text Recognition to advanced visual understanding through Object Detection Beyond Classification: Exploring Advanced Deep Learning Techniques. Ensuring trust and transparency, The Power of Explainable AI (XAI) in Deep Learning: Demystifying Decision-Making Processes complements scalable deployment enabled by RESTful APIs – Optimizing Deep Learning Model Deployment, while Powerful Ways Generative AI is Reshaping the Future of Industries highlights the broader impact of these innovations.

Are you intrigued by the possibilities of AI? Let’s chat! We’d love to answer your questions and show you how AI can transform your industry. Contact Us